| WHAT TO DO WITH A DOLLAR?

By Mark Dyki I hope this is a problem that we all have from time to time. You earn some money, pay off your bills and have to decide what to do with the excess cash. Individuals may choose from a range of options such as investing it in the stock market or having a big night out. We would like to think that the former is more rewarding. In the most simple of terms, public companies must choose to either reinvest the excess in their own affairs or pay it out to shareholders. These capital allocation decisions often have significant influence on future value creation. Typically when companies keep greater portions of earnings, they can reinvest in operations or make acquisitions without depending heavily on external financing. With a little bit of wisdom and luck, both actions result in organic growth. The options to pay down debt or squirrel away cash to bolster future investing power also exist. Absent attractive internal investment opportunities, the company may choose to redistribute the cash back to shareholders in the form of dividends or stock repurchases. Total portfolio returns

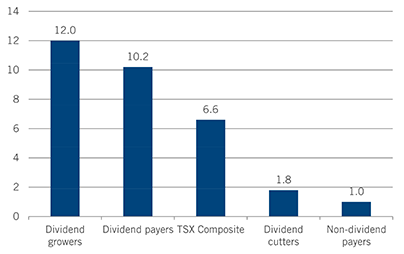

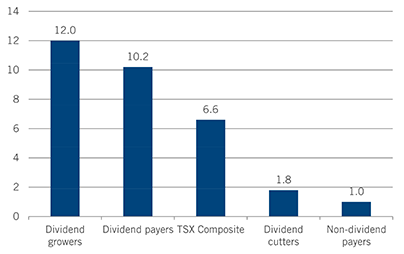

(December 1986 to December 2014, equal weighted %)

Source: RBC Capital Markets Quantitative Research

In general, we prefer to invest in companies that can afford to pay out some cash while remaining disciplined enough to keep something for themselves. Companies that are able grow all aspects of their business (including dividends) at a steady rate make beautiful investments for the long term. Historically, companies that consecutively increased their dividend payments created more value for their shareholders than their peers. Maintaining a healthy payout ratio plays an important role in achieving sustainable organic growth. In recent years record low bond yields forced income seeking investors to look for alternative investments resulting, to a degree, in increased investment in high dividend yielding stocks. In 2012, many companies increased their payout ratio in hopes of catching the bid.

Sensible capital allocation, especially in down cycles, helps to defend against unpredictable future swings in the market. In the oil and gas industry, for example, expectations are already that Canadian exploration and production budgets will be cut by around 35% in 2015. Companies that are less disciplined in managing their capital over the cycle may be forced to sell their assets at discounted prices. If oil prices stay depressed for a prolonged period of time, we may witness this scenario unfold here in Alberta! Source: Mark Dyki, “What to do with a Dollar?,” QV Update, February 6, 2015

|