DIVERGING BOND MARKETS:

US & CANADA

The Canadian bond market returned 3.52% in local currency in 2015, according to the FTSE TMX Canada Universe Bond Index (modified duration 7.44 years). The US bond market returned 0.55% in local currency over the same period according to the Barclays US Aggregate index (modified duration 5.68 years). Why the big difference? Well, over 2015, Canadian Universe yields fell 22 basis points from 2.23% to 2.01%, while US Aggregate yields rose 34 bps, from 2.25% to 2.59% - that is about a half percent swing between Canadian and US yields, from about the same starting point. Another way to look at the year for the two markets, is that investors in both markets started off with the same yield prospect (ignoring currency, which is a bit unrealistic but useful for this discussion) – US investors suffered about a 2% capital loss while Canadian investors made about a 1.3% capital gain, all in local terms.

We make several observations when looking at the Canadian and US returns, beyond the actual performance: i. How little it takes to wipe out yield at today’s levels, as was the case in the US; ii. The yield sensitivity embedded in the Canadian bond benchmark due to the long duration and large weight of long bonds; and iii. The degree to which the Canadian bond market is now priced for perfection.

Janet Yellen has started on a path to “normalize” interest rates (although precisely what “normalize” means is not universally understood) and has made it clear that the Fed will proceed cautiously with “only gradual increases in the federal funds rate”. At the same time, the Bank of Canada (BoC) revised its economic projections for Canada in its October Monetary Policy Report downwards and updated its Framework For Conducting Monetary Policy at Low Interest Rates. Of course, there are those that think the Fed will not be able to carry out its plans to raise rates, due to visible cracks in the global economy – we think the Fed will execute 3-4, 25 bp hikes in 2016.

The strength of the US economy rests mostly with the fortunes of the US consumer. Too much of the global economy is suffering from the fallout of the collapse in commodity prices for the US economy to rely too heavily on exports for an added boost (exports account for only 13.5% of the US GDP). Fortunately, the consumer has been finding jobs and leading domestic growth. To the extent that Canadian exports are levered to US growth, Canadian growth is also benefitting from US demand. However, the depreciation of the Canadian dollar does not appear to be generating the anticipated trade gains as the Loonie is not the only currency that has depreciated against the Greenback and currency-sensitive Canadian export capacity has greatly diminished since the 1990’s.

Softness in the Canadian economy has a good chance of inducing the Bank of Canada into more action in the coming year. We would question the wisdom of Canadian QE, notwithstanding the BoC’s framework for unconventional policy, due to the already very low rate structure in place and our expectations of limited wealth effect from any BoC QE. (Although there has not been a Canadian version of QE, the Canadian yield curve has benefitted indirectly from QE implemented by foreign central banks, which has depressed sovereign yields globally.) We would expect the Bank to first try lowering rates, even to negative levels, before deploying large-scale asset purchases. (We are not conspiracy theorists, but we think that asset purchases would be an ideal complement to the financing needs of a burgeoning federal deficit.)

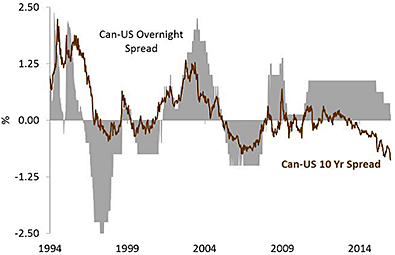

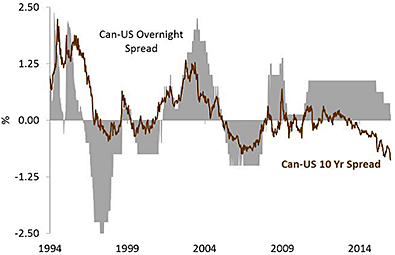

Out-of-sync monetary policies between Canada and the US is not new, and experience over the last thirty years suggests that divergences generally emerge when Canadian policy lags US policy, as is the case today. We expect the growing divergence to stretch yield differentials between the two countries, particularly in the short-end of the yield curve. Longer-term Government of Canada yields tend to follow US Treasury yields, irrespective of the underlying environment. There have been periods of far greater divergence between overnight rates than we have today (see Figure 1), however, we are now at the minimum yield spread between Canada and US 10-year government bonds and close to the minimum for 30-year bonds, of the last thirty years. Longer-term yield spreads will widen as the overnight differential widens, but we expect the amount of widening to decline moving out the yield curve.

Figure 1: Canada – US Overnight Target Rate Spread

Notes: Midpoint of Fed Funds Target Range used

Source: Bank of Canada,

Federal Reserve & Lorica Investment Counsel Inc.; December 2015

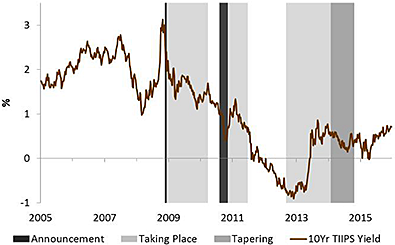

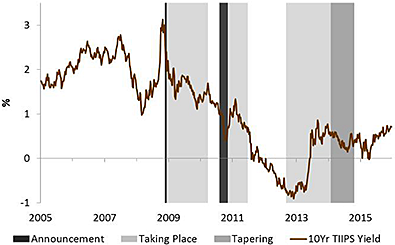

Looking back historically, the US Treasury curve has tended to flatten during periods of rising overnight rates. However, today’s rising rate environment follows a period of unprecedented Fed intervention that has distorted, albeit deliberately, the shape of the yield curve (recall Operation Twist). While we expect the US yield curve to flatten with rising rates, the move will be muted. US real yields across all maturities have been artificially depressed as the result of extensive QE (see Figure 2), and though the Fed has stopped additional Treasury purchases, it is still reinvesting coupon and principal payments. We believe the Treasury curve is therefore flatter than would otherwise be the case, which will prevent investors from flattening the curve too aggressively as the Fed increases overnight rates, in anticipation of an eventual unwind of the Fed’s balance sheet. Prior to the Credit Crisis, the last time the Fed Funds rate was at 1% was in 2003-4 when the US 30 vs 2-year yield curve was about 100 bps steeper than it is today.

The Canadian dollar has typically weakened when US overnight rates move higher than Canadian overnight rates. Granted, there are usually other factors that have a significant impact on the currency – today, it is the substantial decline in energy prices. However, we do not see a rebound in energy prices in the near term and expect the widening of the spread between US and Canadian overnight rates to place additional pressure on the Canadian dollar.

Figure 2: US 10-Year TIIPS Yield with QE

Source: Bloomberg, St. Louis Fed & Lorica Investment Counsel Inc.;

December 2015

Source: Gary Morris, Lorica Investment Counsel Inc, “What We Think”,

December 31, 2015

| |

Dwight Jefferson, CIMA®

Senior Vice President

Portfolio Manager

Tel.: 604.640.0555 • Email

Tyler Steele, CFA

Senior Vice President

Portfolio Manager

Tel.: 604.640.0554 • Email

Paul Rietkerk, CIM, FMA

Portfolio Manager

Tel.: 604.640.0562 • Email

Neil Kumar

Portfolio Manager

Tel.: 604.640.0406 • Email

Wendy Lloyd

Associate

Tel.: 604.640.0556 • Email

Jessica Dewey

Associate

Tel.: 604.640.0405 • Email

Brenda Geib, BA

Associate

Tel.: 604.640.0559 • Email

Richardson GMP Limited

500 – 550 Burrard Street

Vancouver, BC V6C 2B5

Toll Free: 1.866.640.0400

Fax: 604.640.0300

www.JeffersonSteele.ca

|

|

|