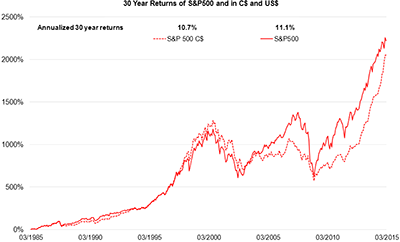

| FIXED INCOME OUTLOOK Q1 2015 Fluctuations in currency markets were the most significant contributor to investment returns for Canadian investors during the first quarter. The 8.6% depreciation of the Canadian dollar versus the U.S. dollar turned an average 4.9% international equity market return into an extraordinary 14.7% return for the quarter. As the chart below shows, this is not something an investor can count on repeatedly as the impact from the fluctuations tends to normalize or cancel out over time. The decline in the Canadian dollar was part of a broader trend of U.S. dollar appreciation, as the Bank of Canada, as well as more than 20 other central banks, provided additional stimulus to economies. Global excess capacity relative to demand is still the order of the day. Click chart to view larger image.

The long-term themes have not changed, central banks continue to implement less and less productive policies in their unilateral attempt to revive economic growth to previous, and ultimately, unsustainable levels. These growth levels were unsustainable because they were fueled by excessive debt growth which almost bankrupted the world financial system. As a result of monetary policy doing the heavy lifting, nominal interest rates through to 10-year maturities are now negative in some European countries. In addition, we have witnessed exceptional growth in money supply and currency market volatility. With every country operating in its own self-interest by intentionally or inadvertently depreciating its own currency, more global economic instability is likely. The Bank of Canada lowered the overnight rate by 0.25% to 0.75% in January. They pointed to a number of negative impacts including declining capital expenditures from the energy sector and a record high household debt/income ratio that will only get worse if incomes decline. The manufacturing sector has also shrunk by 3.5% (to 10.5%) over the last ten years and the economy lacks the fiscal policy spending to offset these negative impacts. By itself the move was not that significant, but when combined with the subsequent currency weakness it may be enough to help stabilize the economy. In contrast, the Fed inched forward on its journey to raise interest rates, effectively removing the extraordinary level of accommodation that it has provided over the past seven years. With the exception of the United Kingdom, the U.S. policy direction is diverging from that of most other countries. This divergence contributed to the extreme currency moves during the quarter with the euro, in particular, declining by 11.3% against the US dollar. The FTSE TMX Canada Universe Index posted a robust 4.2% return for the quarter. There was a dramatic decline in yields, over 50bps, during January as the European Central Bank unleashed its own version of Quantitative Easing. In its attempt to achieve a 2% inflation target over the medium term, it plans to buy over €1trillion of eurobonds through to the third quarter of 2016. These actions prompted a wave of central bank interest rate cuts as each affected country’s currency rate jumped higher against the euro. The Canadian bond market outperformed the U.S. as the Bank of Canada lowered the overnight interest rate, while the Fed laid the groundwork for an increase in interest rates later this year. It is important to note that when the Fed does move to raise interest rates, the magnitude of the increase is unlikely to be anywhere near the 400bps of previous cycles. In addition, with the global economic outlook still modest, and other central banks keeping interest rates exceptionally low, moving short-term interest rates higher may not translate into a proportional rise in long-term rates.

Source: Jarislowsky Fraser

|