“Ever wonder why fund managers can’t beat the S&P 500? ‘Cause they’re sheep — and the sheep get slaughtered. I been in the business since ’69. Most of these high paid MBA types, they don’t add up to dog shit. Gimme guys who are poor, smart and hungry. And no feelings.” – Gordon Gekko in Wall Street (emphasis added). (Wikiquote)

Who knew that Gordon Gekko Oliver Stone’s insights would get backed up in academic research some thirty years later. A recent paper by Oleg Chuprinin and Denis Sosyura demonstrate the challenges portfolio managers from disadvantaged backgrounds have in making it in the investment management business. Below is the abstract from the paper entitled “Family Descent as a Signal of Managerial Quality: Evidence from Mutual Funds” (gated/ungated):

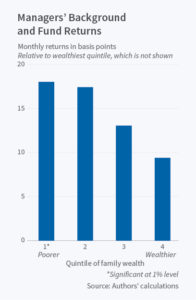

We study the relation between mutual fund managers’ family backgrounds and their professional performance. Using hand-collected data from individual Census records on the wealth and income of managers’ parents, we find that managers from poor families deliver higher alphas than managers from rich families. This result is robust to alternative measures of fund performance, such as benchmark-adjusted return and value extracted from capital markets. We argue that managers born poor face higher entry barriers into asset management, and only the most skilled succeed. Consistent with this view, managers born poor are promoted only if they outperform, while those born rich are more likely to be promoted for reasons unrelated to performance. Overall, we establish the first link between family descent of investment professionals and their ability to create value.

Source: NBER Digest

What you see in the data is that managers from poorer backgrounds have higher realized returns. However this isn’t necessarily because they are better managers. There is something else going on in the hiring and promotion of managers based on family background. Jay Fitzgerald at the NBER Digest writes:

The researchers emphasize that these findings do not imply that those from poor families are in general better at their jobs than those with a more fortunate background. Rather, because individuals from less-privileged backgrounds have higher barriers to entry into prestigious positions, they argue, only the most skilled advance and succeed.

So in some small way Gordon Gekko was right. If you find a manager from a poorer background who has made it through the gauntlet they likely have demonstrable skill. Another finding from the paper also backs up Gekko’s assertion that “high paid MBA types” are “sheep.” In short, they are more likely to be index-huggers in fear of losing face. Fitzgerald writes:

In contrast, those born into poor families are fewer in number and are promoted only if they outperform. They also find that fund managers from less-affluent families who do make it into top ranks are more active on their job: they are more likely to trade and deviate from the market, whereas those born rich are more likely to follow benchmark indexes.

Taking more aggressive bets is one way in which these managers can stand alone from the pack. Timothy Taylor at the Conversable Economist notes that these findings can likely be generalized across fields. He writes:

On practical grounds, there’s no particular reason to believe that the underlying takeaway from the paper applies only to mutual funds. When those who face higher barriers to success manage to overcome those barriers in any occupation, it may often be a sign that their competence level is not just high, but exceptionally high.

This observation is relevant to the issue of gender diversity in asset management. In an earlier post I wrote I hinted at the high motivation a female money manager must have in order to succeed. This research seems to back that up. I wrote:

In addition to thinking differently it also is worthwhile thinking about the motivation of women who come to lead their own investment shop. Those women have likely experience explicit (and implicit) bias during their careers. To get to the point where they are in charge of a portfolio (or firm) shows a level of motivation that is not easily matched by male counterparts who did not have the same challenges.

By now we should all recognize that active management is a tough game. These findings seem to indicate a way to identify managers who have a high level of motivation. Another data point worth considering is identifying fund managers with proverbial “skin in the game,” that is substantial parts of their net worth in the fund. Gordon Gekko may have been an odious (fictional) character, but it sure seems like he had insight into fund managers.