Update | Hong Kong loses IPO crown to New York; slips to No 3 globally, first half data shows

Snap Inc’s blockbuster US$3.9 billion IPO in March helped New York to overtake Hong Kong in terms of new share listings during the first half, according to Thomson Reuters

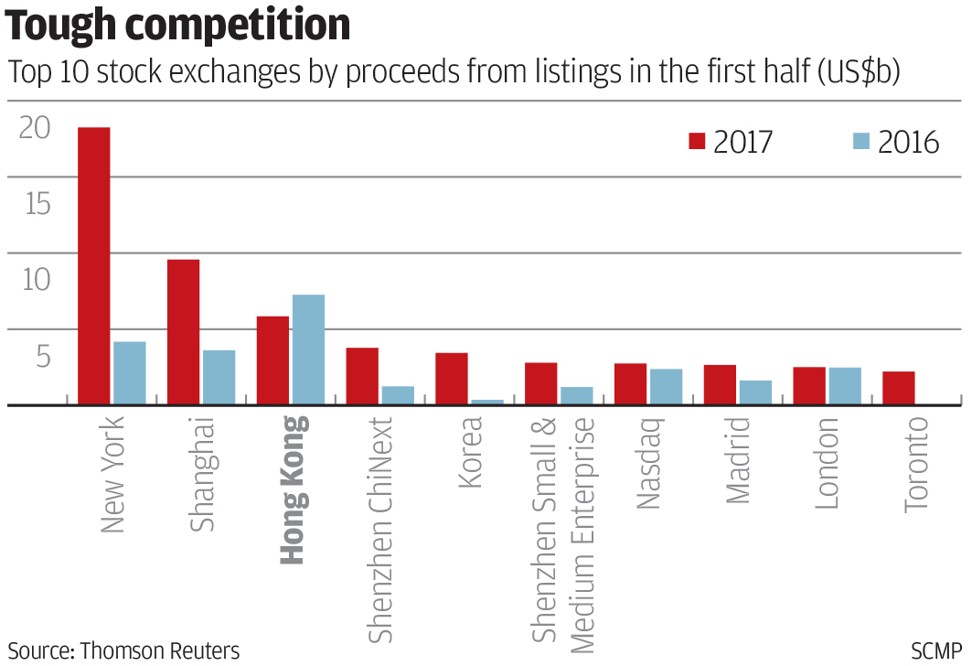

Hong Kong has lost its crown as the world’s favoured destination for companies to raise funds, slipping to the No 3 spot behind New York and Shanghai, amid a dearth of blockbuster listings in the first half, according to preliminary data from Thomson Reuters.

The city’s stock market raised US$5.8 billion worth of IPOs from the start of the year to Friday, a drop of 19.5 per cent from US$7.3 billion in the same period in 2016 when the bourse ranked as the leader for new listings worldwide, according to Thomson Reuters.

The New York Stock Exchange leapt into the top spot, raising US$18.2 billion, partly due to Snap Inc’s IPO in March, which raised US$3.9 billion. The Shanghai Stock Exchange ranked No 2 globally, having raised US$9.6 billion.

Of the funds raised in Hong Kong during the first half, financials accounted for 59 per cent, while technology firms raised only 0.8 per cent, according to Thomson Reuters.

“Hong Kong has lost out to the US as we do not have many new technology or new economy companies while New York has attract these companies. I thus support the stock exchange’s proposal to launch a new board to attract these new economy companies,” said Christopher Cheung Wah-fung, a lawmaker for the financial services sector.

Hong Kong Exchanges and Clearing (HKEX), operator of the local equity and derivative exchanges, released a proposal on June 16 to launch a new board next year, which will operate independently from the main board and the Growth Enterprise Market, but with more flexible rules to attract tech firms.

The third board will have two markets – one for large companies that match all the main board requirements but have dual-share stock structures -- while the other will be for start-ups.

Disallowing firms with a dual-share structure to list in Hong Kong is part of the reason companies have shunned the city for New York, which permits the practise. Snap, the parent company of messaging app Snapchat, listed in New York under a dual shares structure.

Cheung said the establishment of a new board which permits dual share structure firms will help Hong Kong to compete with the US.

“We do not just want the technology to have IPOs here, but we also want to see those technology firms now listed in the US to consider listing in Hong Kong,” Cheung said.

However, some fund managers oppose the dual share structure saying it is unfair to all investors.

The total equity funds raised in the first half year in Hong Kong, comprised mostly of new listings, shares placements, and right issues, amounted to US$15.7 billion, which is up 9.5 per cent from the first half in 2016.